The Ultimate Guide to Budgeting for Millennials

This ultimate guide to budgeting for millennials can create a practical, lifestyle-friendly budget that balances essentials, debt, savings, and enjoyment—without guilt.

Budgeting may not sound exciting, but for millennials navigating rising living costs, student loans, and unpredictable income, it’s a skill that can transform your financial future. Whether you’re earning through a 9-to-5, freelancing, or managing side hustles, a clear budget can bring clarity and control to your money.

1. Why Budgeting Matters for Millennials in Today’s Economy

Millennials face unique financial challenges. From increasing rent prices and stagnant wages to student loan burdens and the pressure of social spending, it’s easy to feel stuck.

A well-planned budget gives you the power to:

- Pay bills on time

- Avoid unnecessary debt

- Save for emergencies and goals

- Spend guilt-free on what matters most

Creating a personalized budget can reduce money stress and help you make informed decisions. It’s not about restriction—it’s about direction.

2. Understand Your Spending Habits First

Before building a budget, take a closer look at your money behavior. Track your income and every dollar you spend for at least 30 days. This gives you a full picture of where your money is going.

Include:

- Fixed costs (rent, loans, insurance)

- Variable costs (groceries, fuel, shopping)

- Irregular income (freelance, gig work)

- Micro-transactions (subscriptions, coffee runs, app purchases)

You can use apps like Mint, YNAB, or even Google Sheets to monitor your cash flow.

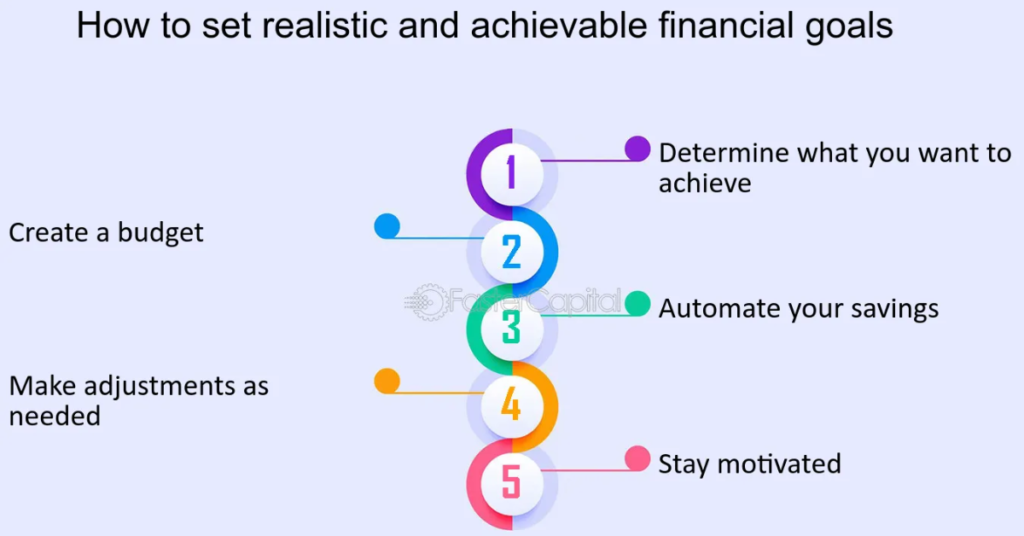

3. Set Specific and Achievable Financial Goals

Budgeting without goals is like driving without a destination. Set clear short-term and long-term financial goals to give your money a purpose.

Short-term goals might include:

- Saving $500 for emergencies

- Paying off a credit card

- Planning a debt-free vacation

Long-term goals may include:

- Buying a home

- Building retirement savings

- Starting a business

Use the SMART goal method: Specific, Measurable, Achievable, Relevant, Time-bound. Write them down and revisit them monthly.

4. Choose the Right Budgeting Method for Your Lifestyle

There’s no one-size-fits-all method. Pick a budgeting style that matches your lifestyle and income type.

Popular budgeting methods:

- 50/30/20 Rule: Allocate 50% to needs, 30% to wants, 20% to savings and debt.

- Zero-Based Budgeting: Every dollar is assigned a role; total income minus total expenses = zero.

- Envelope System: Cash-based, divide money into categories in physical envelopes.

- App-Based Budgeting: Use digital tools to categorize and automate your budget.

If your income fluctuates, focus on a baseline budget that covers essentials first.

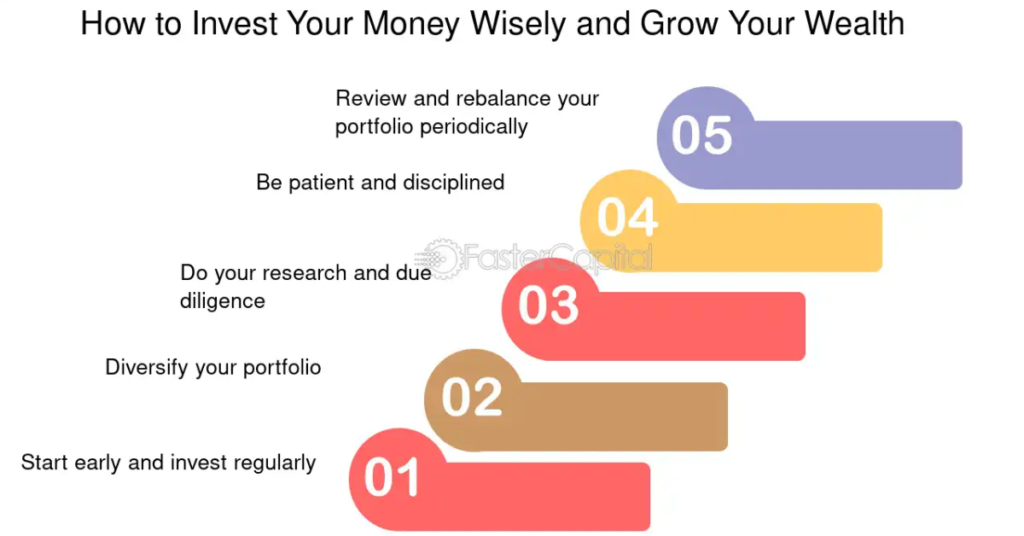

Also Visit This Top 5 Investment Options

5. Build Your Emergency Fund Before Investing

An emergency fund is your safety net. It protects you from unexpected events like job loss, medical emergencies, or car repairs.

How to build one:

- Aim for $500–$1,000 to start, then build up to 3–6 months of essential expenses.

- Open a separate high-yield savings account.

- Set up automatic transfers of even $20 per week.

Skip this step, and you risk derailing your finances when life throws you a curveball.

6. Tackle Debt with a Strategy

Most millennials are juggling some form of debt—student loans, credit cards, or personal loans. Don’t ignore them. Make a plan.

Two proven payoff strategies:

- Avalanche Method: Pay off high-interest debt first (saves money over time).

- Snowball Method: Pay off smallest balances first (motivating progress).

Look into refinancing, debt consolidation, or income-driven repayment plans if your payments are overwhelming.

7. Budget for Enjoyment Without Guilt

Budgeting shouldn’t feel like punishment. Millennials value experiences, and it’s important to enjoy your life too.

Budget for fun:

- Include a “fun fund” or lifestyle category in your budget.

- Use cash or prepaid cards for entertainment to avoid overspending.

- Look for free or low-cost events, especially if you’re saving aggressively.

Spending consciously means you can enjoy life without sabotaging your future goals.

8. Automate and Adjust Your Budget Regularly

Life changes, and so should your budget. After creating your budget, automate your financial life as much as possible.

Automate:

- Bill payments to avoid late fees

- Transfers to savings and investment accounts

- Budget updates with tracking apps

Review and revise your budget monthly. Adjust for new expenses, income changes, or goals. Budgeting is a living document, not a one-time task.

9. Use Financial Technology to Your Advantage

Modern apps make budgeting easier than ever. You don’t need to be a spreadsheet expert to take control.

Best budgeting apps for millennials in 2025:

- YNAB (You Need A Budget): Great for zero-based budgeting

- Mint: User-friendly for expense tracking

- Rocket Money: Helps cancel unwanted subscriptions

- PocketGuard: Shows what’s “safe to spend” after bills

Choose a tool that suits your financial style and comfort level.

10. Stay Motivated and Celebrate Progress

Budgeting is a long-term commitment. To stay motivated:

- Set small goals and reward yourself when you hit them

- Join financial communities or forums for support

- Use visual tools like trackers or milestone charts

- Remind yourself of your “why”—whether it’s freedom, travel, or homeownership

Building a healthy relationship with money takes time, but small wins compound over months and years.

Conclusion

Budgeting doesn’t mean you can’t have fun. It means you’re in charge of your financial story. In a world where millennial challenges include unpredictable job markets, rising costs, and social pressures, budgeting is your most valuable tool.

One Comment