How to Lower Your Car Insurance Premium Legally

How to Lower Your Car Insurance Premium Legally – Paying too much for car insurance? This comprehensive guide explains proven and legal methods to reduce your premium without compromising on coverage. Learn how smart policy choices, clean driving habits, No Claim Bonuses, and usage-based insurance can significantly cut costs in 2025. Whether you’re a new driver or renewing your policy, these expert tips will help you save money the right way.

1. Understand What Affects Your Car Insurance Premium

Before you can reduce your car insurance cost, you need to understand what drives it up. Insurance companies assess multiple risk factors before setting your premium:

- Type of vehicle: Expensive or high-performance cars usually cost more to insure.

- Age and experience of the driver: Young or new drivers typically face higher premiums.

- Driving history: Accidents, traffic violations, and past claims can raise rates.

- Location: High-theft or accident-prone areas may result in higher premiums.

- Coverage type and add-ons: Comprehensive coverage and optional add-ons increase the price.

- Claim history: A clean record often leads to discounts and rewards like the No Claim Bonus.

Knowing these elements can help you target specific areas to reduce your costs.

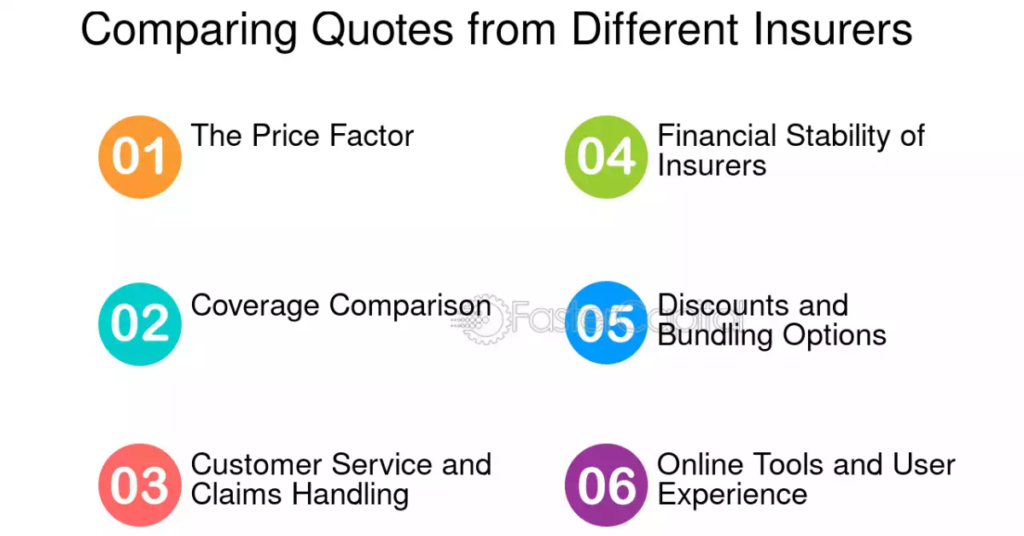

2. Compare Quotes from Multiple Insurers

One of the most effective ways to reduce your premium is by comparing car insurance quotes online. Each insurer uses different pricing models, and rates can vary significantly for the same coverage.

Use trusted car insurance comparison websites to view quotes side-by-side. Make sure you’re comparing similar features, deductibles, and exclusions—not just the price. You may find that a lesser-known insurer offers better value and service than a large one.

Tip: Reevaluate your options every renewal cycle, even if you’re happy with your current provider.

3. Opt for a Higher Voluntary Deductible

A deductible is the amount you agree to pay out-of-pocket before your insurance kicks in. Choosing a higher voluntary deductible can significantly lower your premium because it reduces the insurer’s risk.

However, make sure the deductible is affordable for you during a claim. Don’t choose the maximum deductible if you can’t realistically pay it in an emergency.

Best for: Experienced drivers with a clean driving record.

4. Remove Unnecessary Add-Ons

Add-ons enhance your policy but also increase your premium. Common add-ons include:

- Zero depreciation cover

- Roadside assistance

- Engine and gearbox protection

- Return to invoice cover

Evaluate if these are truly necessary based on your vehicle’s age and your driving habits. Avoiding unnecessary car insurance add-ons can save you hundreds annually.

5. Maintain a Clean Driving Record

Insurers reward safe drivers. A history of traffic violations, accidents, or DUIs increases your risk profile, leading to higher premiums.

To reduce your insurance costs:

- Follow traffic rules

- Avoid aggressive driving

- Stick to speed limits

- Avoid night-time driving in high-risk zones

Safe driver discounts are offered by many companies, especially those using AI and telematics.

6. Leverage the No Claim Bonus (NCB)

The No Claim Bonus is a discount given for every claim-free year. It can go as high as 50% after 5 consecutive years without a claim.

Key tips:

- Don’t file claims for minor damages

- Transfer your NCB if switching insurers

- Check if your insurer offers NCB protection add-on (useful if you need to make a claim but don’t want to lose your bonus)

The longer you go without filing a claim, the lower your renewal premium becomes.

7. Install Approved Anti-Theft and Safety Devices

Installing anti-theft devices approved by regulatory bodies (like ARAI in India or Thatcham in the UK) can earn you a discount on your premium. These include:

- Car alarms

- Immobilizers

- Steering locks

- GPS tracking systems

These devices reduce the risk of theft and damage, which means less liability for the insurer.

Also Visit This The Future of Car Insurance

8. Choose the Right Insurance Coverage Type

If you own an older vehicle or a car with low market value, switching from comprehensive insurance to third-party insurance might make sense—especially if the cost of full coverage is higher than the value of the car.

However, this should be done carefully. If your car is still worth repairing or if you drive in high-risk areas, a comprehensive policy may be the safer choice.

9. Bundle Insurance Policies for Discounts

If you already own life, health, or home insurance, ask your provider about multi-policy discounts. Bundling your policies with one insurer often qualifies you for special rates and loyalty bonuses.

This is one of the easiest legal ways to reduce car insurance premiums, especially if your insurer encourages multi-line policyholders.

10. Renew On Time to Avoid Penalties

Letting your policy lapse—even for a day—can increase your premium significantly. Insurers often treat lapsed policyholders as new customers, eliminating loyalty discounts and NCB benefits.

Set reminders for your renewal date and review your policy a few weeks before expiration. Timely renewal also ensures you’re not uninsured, which can lead to legal penalties and claim rejection.

11. Consider Usage-Based Car Insurance (Pay-As-You-Drive)

In 2025, many insurers offer usage-based insurance plans. These plans use telematics to assess how, when, and how far you drive.

They reward low-mileage drivers, seniors, students, and safe drivers with lower premiums. If you don’t drive frequently, or only during off-peak hours, you can benefit from:

- Pay-per-mile plans

- Pay-how-you-drive plans

- Driving score discounts

Install your insurer’s tracking app or device to start building your safe driving score.

12. Choose the Right Insurer

Beyond price, your insurer’s reliability matters. Choose a provider with:

- High claim settlement ratio

- Transparent pricing policies

- Easy claim process

- Good customer reviews

Some insurers are tech-forward and offer AI-powered car insurance premium optimization, rewarding responsible drivers more fairly than traditional companies.

Conclusion: Lowering Car Insurance Costs the Smart Way

You don’t need to compromise on coverage or engage in illegal shortcuts to legally lower your car insurance premium. By understanding how insurance companies calculate risk and implementing smart strategies like comparing quotes, adjusting your deductible, and maintaining a clean driving history, you can reduce your costs significantly.

Remember, insurance is about risk management. If you can demonstrate that you’re a low-risk driver through your behavior, vehicle safety, and driving habits, you’ll enjoy better rates—without sacrificing protection.