How to Get Out of Debt Faster: Proven Strategies

This guide covers How to Get Out of Debt Faster: Proven Strategies, without relying on gimmicks or shortcuts. Whether you’re dealing with credit card debt, personal loans, or student loans, you’ll find practical steps that actually work.

Being in debt is more than just a financial burden—it’s a source of stress, anxiety, and lost opportunities. In 2025, with rising living costs and increasing interest rates, getting out of debt has never been more urgent. The good news is that millions of people have done it—and you can too.

1. Know Exactly How Much You Owe

The first step to financial freedom is full awareness. List every debt you owe, including:

- Credit cards

- Student loans

- Auto loans

- Medical bills

- Personal loans

Write down the balance, interest rate, and minimum payment for each one. This will give you a clear starting point and help you choose the best repayment strategy.

You can use a spreadsheet, budgeting app, or even pen and paper to organize your debts.

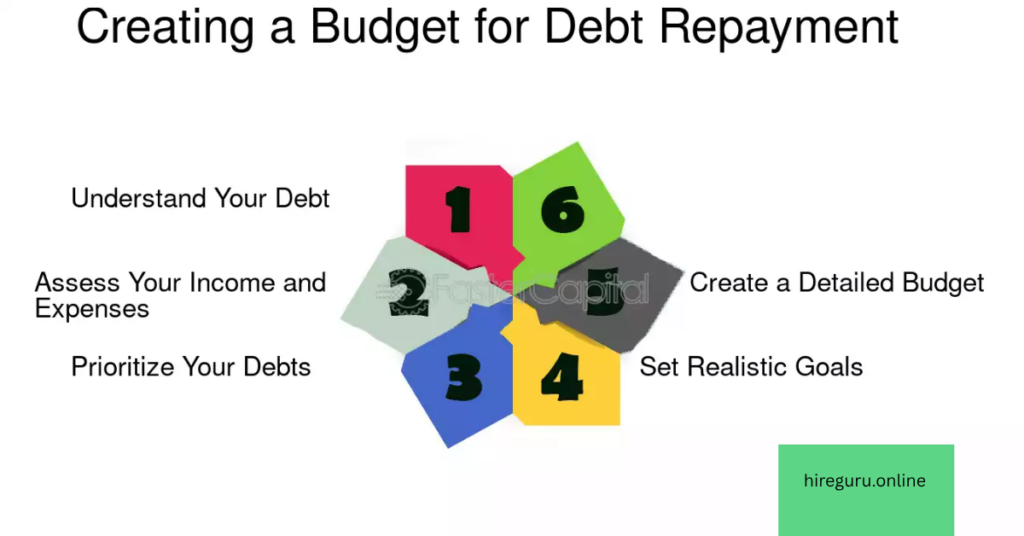

2. Create a Budget That Prioritizes Debt Payoff

Once you know what you owe, the next step is building a realistic monthly budget that supports debt elimination.

Start by tracking your monthly income and fixed expenses (rent, groceries, utilities, etc.). Then, cut back on non-essentials like subscriptions, takeout, and impulse spending. Every dollar saved should go toward extra debt payments.

Apps like YNAB, Goodbudget, or a simple Google Sheet can help you stay on track.

3. Choose Between the Snowball and Avalanche Method

There are two popular strategies for paying off multiple debts:

Snowball Method

- Focus on paying off the smallest balance first.

- Make minimum payments on the rest.

- Each paid-off debt builds motivation.

Avalanche Method

- Focus on the debt with the highest interest rate.

- Saves more money over time.

- Takes discipline but is mathematically efficient.

Pick the one that best matches your personality. The key is to stay consistent.

4. Automate Your Payments

Missing payments leads to late fees, interest hikes, and credit score damage. The easiest fix? Set up automatic payments.

- Automate your minimum payments to avoid penalties.

- Schedule extra payments toward your focus debt manually or automatically.

- Use banking apps to receive reminders before due dates.

Automation helps you stay disciplined without relying on willpower alone.

5. Boost Your Income to Speed Up Debt Payoff

Sometimes, cutting expenses isn’t enough. Increasing your income can accelerate your debt-free journey dramatically.

Ways to make extra money:

- Take up a freelance side hustle (writing, design, social media, tutoring)

- Deliver for services like Uber Eats or DoorDash

- Sell unused items on Facebook Marketplace or eBay

- Rent out a spare room or car

- Use tax refunds or bonuses to make lump-sum payments

Every extra dollar should go toward your highest-priority debt.

6. Negotiate Better Terms with Creditors

Many people don’t realize you can actually negotiate with creditors. In 2025, companies are still willing to work with you—if you ask.

Try this:

- Call your credit card company and ask for a lower APR

- Request a temporary hardship plan

- Refinance your personal loan at a better rate

- Consolidate multiple high-interest debts into one low-interest loan

Always work with reputable lenders and avoid scams promising “debt relief” without clear terms.

7. Avoid Taking on New Debt

While you’re paying off current debt, the last thing you want is to add more. Avoid these traps:

- Stop using credit cards unless absolutely necessary

- Freeze or cut up cards to remove temptation

- Avoid “buy now, pay later” services

- Use cash or debit for everyday spending

Focus on living within your means during your debt repayment journey.

Also Visit This Passive Income Ideas

8. Use Debt Tracking Tools for Motivation

Staying motivated during a long debt repayment journey can be difficult. Celebrate every milestone to keep your spirits up.

Tools and techniques:

- Use debt-tracking apps like Undebt.it or Tally

- Create a visual debt thermometer and color it in as you pay

- Set milestone goals (e.g., every $1,000 paid off = reward)

Celebrate responsibly—like a home spa night or favorite meal—not by splurging with a credit card.

9. Use Windfalls Wisely

If you receive a tax refund, stimulus payment, inheritance, or work bonus, resist the urge to spend it. Use it to eliminate debt faster.

A $1,000 windfall could wipe out a small loan or slash months off a credit card balance. Make your money work harder for your goals.

10. Consider Professional Help (When Needed)

If your debt feels overwhelming and your income can’t keep up, don’t be afraid to ask for help.

Look into:

- Nonprofit credit counseling agencies

- Debt management programs (DMPs)

- Financial coaches or budgeting counselors

Make sure the agency is certified by the NFCC (National Foundation for Credit Counseling) or Financial Counseling Association of America.

Avoid companies that charge large upfront fees or promise instant results.

Conclusion

Becoming debt-free isn’t just about money—it’s about peace of mind, freedom, and opportunity. The process may take time, but the payoff is worth every effort.

One Comment